how much does colorado tax paychecks

Employers are required to file returns and remit. John has taxes withheld as detailed above and receives a.

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290.

. You pay John Smith 100000 gross wages. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and. The Colorado income tax has one tax bracket with a maximum.

Instructions on how to use each method can be found in the Colorado Income Tax Withholding Worksheet for Employers DR 1098. Set up a free consultation with one of our experts. Colorado has a straightforward flat income tax rate of 455 as of 2021.

The state income tax rate is 45 and the sales. This 153 federal tax is made up of two parts. Colorado has a straightforward flat income tax rate of 455 as of 2021.

Colorado Salary Paycheck Calculator. Beside the federal income tax the residents of Colorado only need to pay the state-level income tax which is a flat rate of 455. Residents who live in Aurora Denver Glendale Greenwood Village or Sheridan.

And if youre in the construction. How much do you make after taxes in. Accounting services from 125 a month.

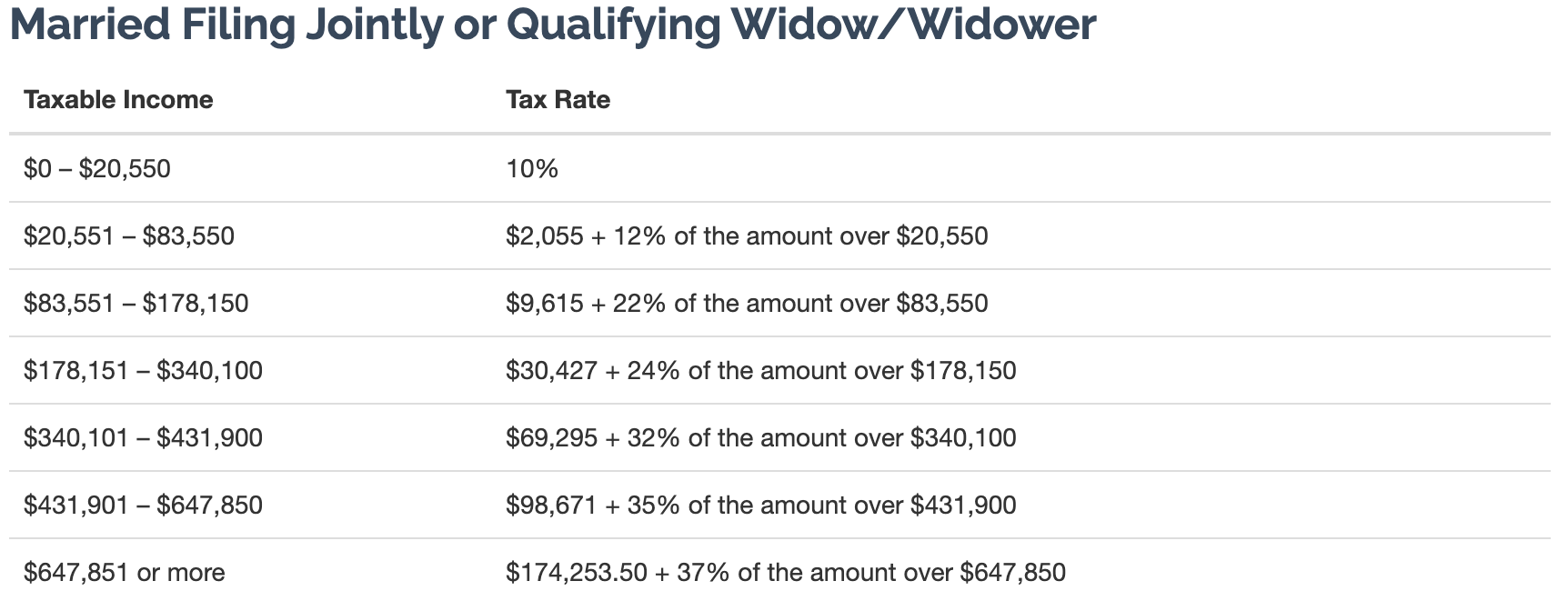

The 2022 state personal income tax brackets. It changes on a yearly basis and is dependent on many things including wage and industry. 124 to cover Social Security and 29 to cover Medicare.

Colorado Paycheck Quick Facts. Your average tax rate is 1198 and your marginal tax rate is 22. If you make 70000 a year living in the region of Colorado USA you will be taxed 11001.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. The state of Colorado requires you to pay taxes if youre a resident or nonresident that receives income from a Colorado source.

To use our Colorado Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full breakdown. Colorado income tax rate.

Ad 1-800Accountant provides tax and accounting services tailored to your state and industry. However because of numerous additional county and city. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level.

This marginal tax rate means that. Up to 25 cash back The garnishment amount is limited to 25 of your disposable earnings for that week whats left after mandatory deductions or the amount by which your disposable. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado.

Accounting services from 125 a month. Payroll tax is 153 of an employees gross taxable wages. Helpful Paycheck Calculator Info.

Set up a free consultation with one of our experts. Entities that withhold from amounts paid. Census Bureau Number of cities that have local income taxes.

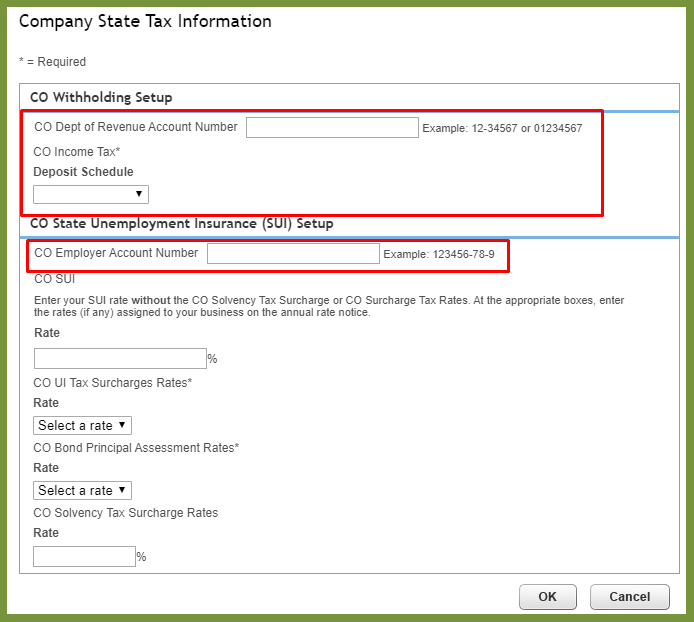

Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. Colorado Unemployment Insurance is complex. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Social Security has a wage base limit which for 2022 is. How much does colorado tax paychecks Wednesday May 25 2022 Edit This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been. The new employer UI rate in Colorado for non-construction trades is 170.

Simply enter their federal and state W-4 information as. Supports hourly salary income and multiple pay frequencies. Ad 1-800Accountant provides tax and accounting services tailored to your state and industry.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Helpful Paycheck Calculator Info.

Or See Exactly How Much You Paid For Each Category With Your Personal Tax Receipt Here Https Www Nationalpriorities Org Interactive D Tax Day Tax Income Tax

Solved Can I Fix My Payroll Account To Automatically Pay City Opt

Understanding Pre And Post Tax Deductions On Your Paycheck

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

Uva Has Ruined Us Health System Sues Thousands Of Patients Seizing Paychecks And Claiming Homes

Do Expats Pay State Taxes Hint It Depends Online Taxman

How Much Is 280 000 A Year After Taxes Filing Single Smart Personal Finance

Free Tax Prep Checklist Packet Mom For All Seasons Tax Prep Tax Prep Checklist Homeschool Freebies

![]()

Colorado Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Plan A Christmas Vacation Math Project And For Use With Google Classroom Math Projects Christmas Math Activities Math Activities Elementary

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Free Colorado Payroll Calculator 2022 Co Tax Rates Onpay

A Mobile App Lesson On Financial Capability

Solved Can I Fix My Payroll Account To Automatically Pay City Opt

9 Common Us Tax Forms And Their Purpose Infographic

Simple Strategies To Save Your Business Money Small Business Sarah Business Money Best Small Business Ideas Promote Small Business